Inflation and Economy: Ongoing Concerns About Inflation’s Impact on Household Spending and Investments

As the economy continues to grapple with persistent inflation, households across the United States are feeling the squeeze. With rising prices affecting everyday expenses, concerns are mounting about how inflation will impact consumer spending and investments moving forward.

Current State of Inflation

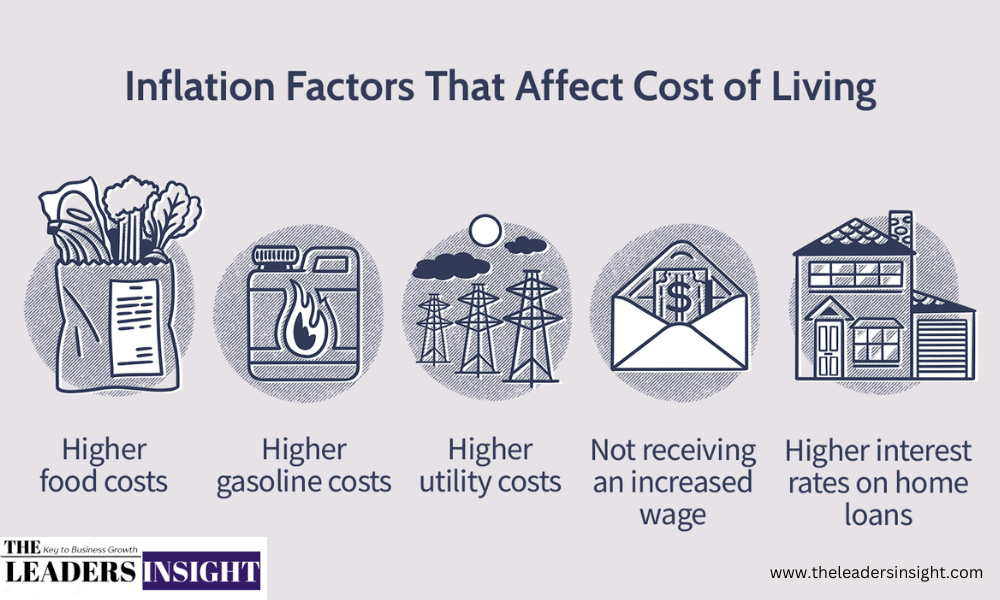

Recent reports indicate that inflation remains a critical issue, with the Consumer Price Index (CPI) showing a year-over-year increase of around 4.3% as of September 2024. Essential goods and services, such as food, housing, and transportation, have seen the most significant price hikes. The ongoing effects of supply chain disruptions and geopolitical tensions are contributing to these price increases, creating uncertainty for consumers and investors alike.

Impact on Household Spending

For many households, inflation has led to tighter budgets and more cautious spending habits. The rising cost of necessities means that families are forced to allocate a larger portion of their incomes to cover basic needs. According to a recent survey by the Federal Reserve, nearly 60% of respondents reported that they are cutting back on discretionary spending due to higher prices.

This reduction in spending is particularly noticeable in sectors such as retail and dining, where consumers are opting for budget-friendly alternatives. Businesses are also feeling the impact, as reduced consumer spending affects their revenues and growth prospects. Retailers have reported lower foot traffic and declining sales figures, forcing them to adjust their strategies to attract cost-conscious shoppers. The Wall Street Journal

Effects on Investments

Inflation’s impact extends beyond household spending; it also poses challenges for investors. Rising prices can erode the purchasing power of cash, making traditional savings accounts less appealing. Consequently, individuals are looking for alternative investment options to hedge against inflation.

Many financial experts recommend considering assets such as real estate, commodities, and inflation-protected securities like Treasury Inflation-Protected Securities (TIPS). These investments can potentially provide a safeguard against rising prices, allowing investors to maintain their purchasing power over time. Bloomberg

However, the stock market is facing volatility as investors navigate these inflationary pressures. Companies are experiencing rising input costs, which may squeeze profit margins and lead to lower earnings projections. As a result, some investors are becoming more selective about where they place their capital, focusing on sectors that can weather inflation better than others.

Government and Federal Reserve Responses

In response to persistent inflation, the Federal Reserve has signaled its commitment to tightening monetary policy. Interest rates have been gradually increased to curb inflation, with further hikes anticipated in the coming months. Higher interest rates can slow down borrowing and spending, which may help stabilize prices but could also lead to a cooling economy.

The government has also implemented various measures to mitigate inflation’s impact, including targeted relief programs aimed at assisting low- and middle-income families. These initiatives are designed to help households cope with rising costs, providing support where it is needed most.

Looking Ahead: Economic Outlook

As we move into the final months of 2024, the outlook for inflation and the economy remains uncertain. While some analysts predict a gradual decline in inflation rates as supply chain issues are resolved, others caution that geopolitical factors and ongoing labor shortages could continue to exert upward pressure on prices.

Households will need to remain vigilant, monitoring their spending habits and adapting to changing economic conditions. Investors, too, must stay informed about market trends and consider adjusting their portfolios to navigate the inflationary landscape.

For regular updates on economic trends and insights, follow us on LinkedIn at The Leaders Insight and on Instagram at The Leaders Insight Instagram